irs child tax credit tool

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. One of three tools now available for the upcoming advance payments After checking the Eligibility.

Expanded Child Tax Credit Senator Bernie Sanders

WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility.

. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July. As a part of the Act the IRS will pay eligible taxpayers half of their estimated 2021 Child Tax Credit in advance monthly payments beginning in July 2021.

The childs age must be under 6 or 17 and. You can use your username and password for. Similar to certain other credits with an advance payment option taxpayers who receive.

The new collaboration with Code for. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers who didnt qualify. Parents can now check their eligibility for the expanded child tax credit and manage their payments which begin next month using two online tools the Internal Revenue.

It offers a free and easy way for eligible people who dont normally have to file taxes to provide the IRS the basic information needed name address and Social Security. IRS-approved official E-file provider. This new tool is accessible just on IRSgov.

The Child Tax Credit. IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021. Use our simplified tax filing tool to claim your Child Tax Credit Earned Income Tax Credit and any missing amount of your third stimulus payment.

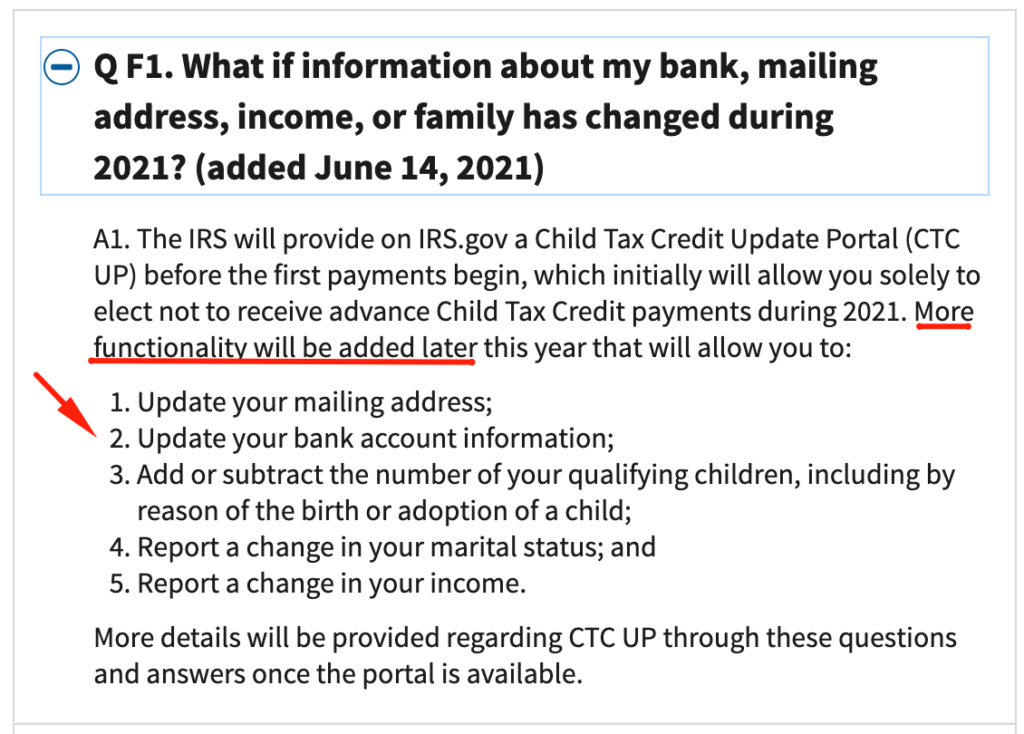

IRS Resources and Guidance Includes e-posters in other languages user. IR-2021-150 July 12 2021. Notify the IRS of an address or name change to make sure the IRS can process your tax return send your refund or contact you if needed.

The IRS has launched an online tool to help low-income families register for monthly child tax credit payments. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. IRS online tool helps families see if they qualify for the Child Tax Credit.

Advance Child Tax Credit. Families who guarantee the Child Tax Credit for 2021 will get up to 3000 per qualifying child who is somewhere in the range of 6 and 17 years of. The American Rescue plan increased the maximum Child Tax.

For 2021 eligible families can claim up to 3600 per qualifying child under age 6 and 3000 per qualifying child between 6 and 17 with the expanded Child Tax Credit. Who should use the. But it doesnt work on mobile devices which advocacy.

If you have at least one qualifying child and earned less than 24800 as a married couple 18650 as a Head of Household or 12400 as a single filer you can use the Code for America. The payments will be up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 through 17. Visit ChildTaxCreditgov for details.

The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

The Child Tax Credit Non Filer Tool Is A Mess People S Policy Project

Child Tax Credit Irs Launches 2 Online Tools To Answer Eligibility Questions

Child Tax Credit Portal How To Use The Irs Tool To Enroll For 2021 Nj Com

Irs Tool Helps Low Income Families Register For Monthly Child Tax Credit Payments Tax Pro Center Intuit

Irs Child Tax Credit Tool Opens For Low Income Americans Weareiowa Com

Child Tax Credit New Irs Tool Aims To Get Checks To Your Mailbox Faster Abc4 Utah

Irs Online Child Tax Credit Eligibility Tool Now Available In Spanish Larson Accouting

Irs Website Has Tool To Update Direct Deposit Info For Child Tax Credit

Irs Announces Two New Online Tools To Help Families Manage Child Tax Credit Payments News Tapinto

Are You Eligible For Monthly Child Tax Credit Payments Check Irs Eligibility Tool Al Com

Irs Issues Child Tax Credit Faqs And Online Non Filer Tool

Irs Launches New Tool To Get Child Tax Credit Payments To Non Filers

Irsnews On Twitter Irs Offers The Child Tax Credit Eligibility Assistant In English And Spanish This Interactive Tool Can Help Your Family Determine Whether You Qualify For The Childtaxcredit See Https T Co 535gr8o86p Hhm

Reports Suggest Irs Child Tax Credit Tool Is Having Problems The National Interest

Irsnews On Twitter An Irs Tool Now Enables Families To Quickly And Easily Unenroll From Receiving Monthly Payments Of The Childtaxcredit If They So Choose Https T Co Qt9tauwjvv Https T Co Zmqoijn0gv Twitter

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Launches New Child Tax Credit Eligibility Tool Sheridan Media

Irs Unveils Tool To Opt Out Of Monthly Child Tax Credit Payments